Business Valuation Details

By now, it’s likely you are seriously considering engaging a business valuation professional. This page is intended to prepare you for how I go about giving you a meaningful business valuation.

This means the business valuation process is planned, deliberate and detailed. It’s my goal to educate you about the experience, in advance, so you can fully understand the entire process before you may begin.

There much to know about the business valuation process. This web page is intended to bring you a positive business valuation experience, and outcome, by giving you the information you need.

Many of your unanswered questions are answered here. It’s my desire to give you a look at the entire experience from start to completion. You can sit back and read about the topics you are most interested in, without much clicking. As you scroll down, more information is available about each topic. Please browse at your leisure. When you are done, and you’ve found the bottom of this page, there is an opportunity for you to contact me if you choose to do so.

clients served

%

Satisfaction

Available Reports

What Is The Formal Valuation Report And What Options Go With It?

This formal business valuation report provides three methods of valuation and considerable explanations for the methods used and the accompanying financial information.

The business valuation may appear to be your most urgent need. It focuses strictly on what the company is worth. If you need to take this valuation further, it’s your choice to consider an independent and objective opinion profiling the VALUE and HEALTH of the company. This optional report is the business condition assessment report. Below is information about each report. Business valuations are based on the premise that buyers of businesses value the cash stream generated by the business and by examining comparable valuations on the business sales market.

The Business Valuation Report

Business valuations are both an art and a science. The science means multiple predetermined methodologies such as income-based valuations and market-based valuations are followed. The art involves assessing risk, judging management and evaluating the state of the marketplace and the position of the target company within it and many other factors.

The business valuation report is intended to show what someone would be willing to pay for a company. It includes applying valuation industry practices for the business valuation and explanations for many methods and financial terms used in the report.

A business valuation uses the past three years of performance, five years of projected performance, and three different valuation methods to determine an estimated range for a valuation, and a single valuation figure.

Please see the additional information about AICPA SSVS #1 and USPAP for more information about valuation Industry standards we apply to prepare your business valuation.

AICPA SSVS No 1

Our report meets the American Institute of CPA’s (AICPA) Statement of Standards For Valuation Services No. 1 (SSVS #1)

USPAP

All business valuation we prepare for you adheres to Uniform Standards of Professional Appraisal Practice (USPAP). This means you get a valuation that is designed with care and deliberate forethought because these professional standards address all aspects of a business valuation. The standards address everything from your education, the sales process, disclosures, the engagement letter, the valuation preparation and much more. Ultimately, it presents a quality standard which benefits you. While we meet these standards, the fact you are reading this page means we are exceeding the standards expected of us to serve you.

Overview

The Formal Business Valuation Report

This video gives you a view into our formal business valuation report.

6 Reports In 1

Business Condition Assessment Report

The Business Condition Assessment Report is intended to provide you with an independent and objective exhibit of the current health of the company AND to provide the SAME business valuation exhibited in the separate business valuation report. Here you can look at all 6 reports included in the complete Business Condition Assessment report through videos highlighting what you get in each section. You are encouraged to browse the videos you are most interested in viewing.

Executive Summary

This executive summary report is a high-level look at the current condition of your company. This helps if you don’t want to browse the deeper report details.

Cash Driver Report

This cash driver report is intended to show how your company generates cash. Some ways are normal and healthy, others may not be. This can tell you if your company is genuinely generating cash or if you are struggling and using other creative, and risky cash generation methods.

Profit Driver Report

This profit driver report is intended to show how well your company reacts to fluctuations in sales and what happens to the company profits as sales change. This can tell you about management’s adaptability to rapidly changing business conditions.

Business Valuation Report

This business valuation report provides three methods of valuation and considerable explanations for the methods used and explains many of the financial terms and analysis provided. This easily tells you what your company is worth.

Lending Report

This lending report provides a look at how your company may appear to lenders, your capacity on the balance sheet to borrow funds and your lending risk ratings. This can be invaluable for any company considering financing.

Industry Comparable Report

This industry comparable report provides a comparison of your company’s performance to other competing industry participants performance and highlights where your company performance may over or underperform industry peers. This is just one way, a popular way, of identifying the industry position of a company. This can make the difference of seeing, or not seeing a company’s position and advantages in the marketplace.

F.A.Q.

Common Questions

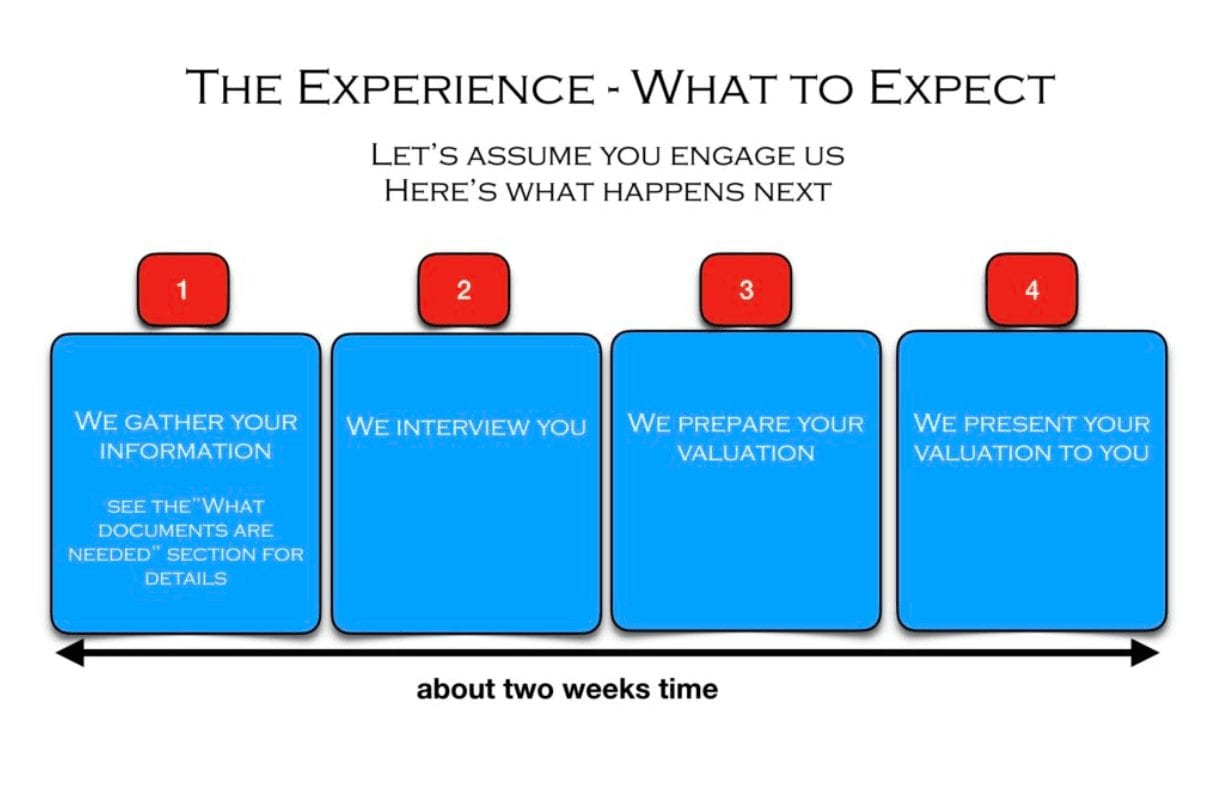

What can I expect from the valuation experience?

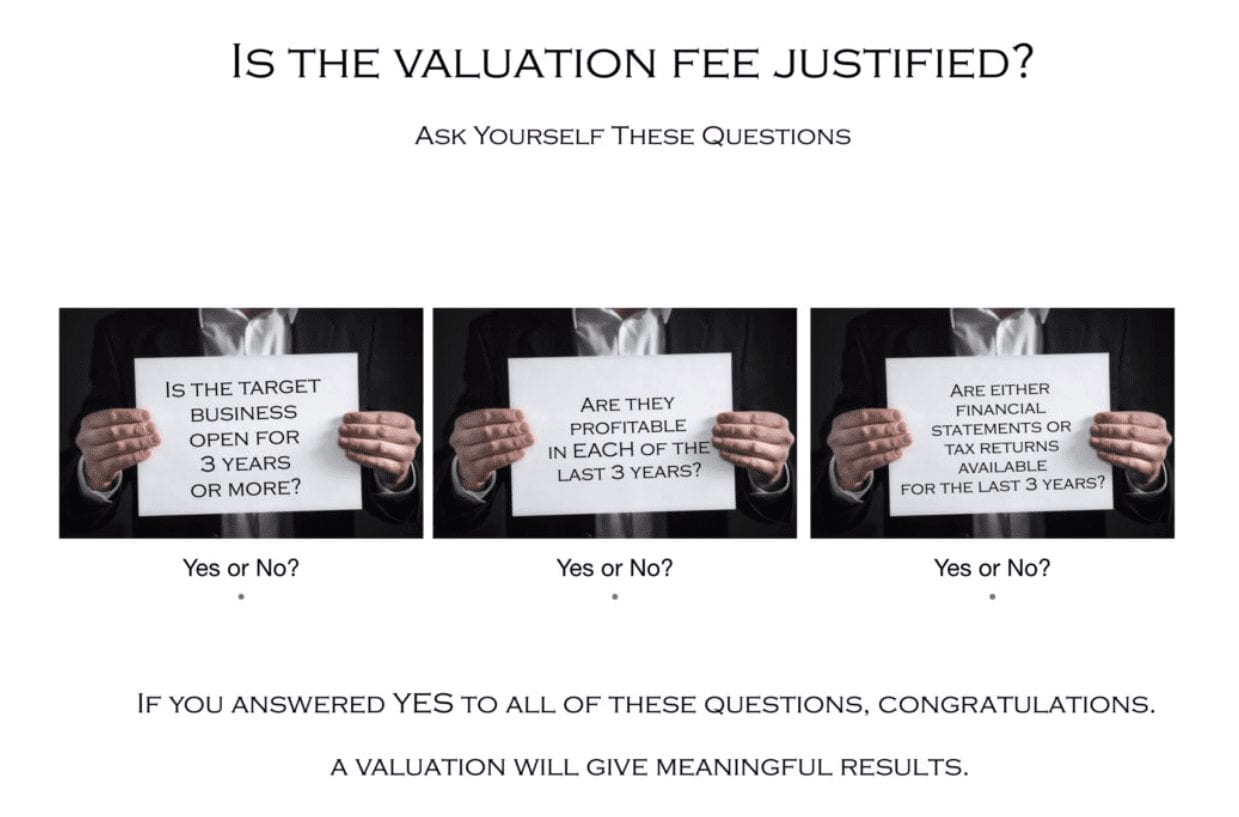

How do I know a valuation will give me meaningful results?

Business conditions may vary greatly from company to company. Some business conditions will not yield a valuation at all. We prefer to ask you three questions in advance to determine if you will receive a valuation result that is meaningful and valid. Answering “Yes” to all three questions means a meaningful and valid valuation is in your future. If you answered no to any of these questions, we do not advise undertaking a business valuation.

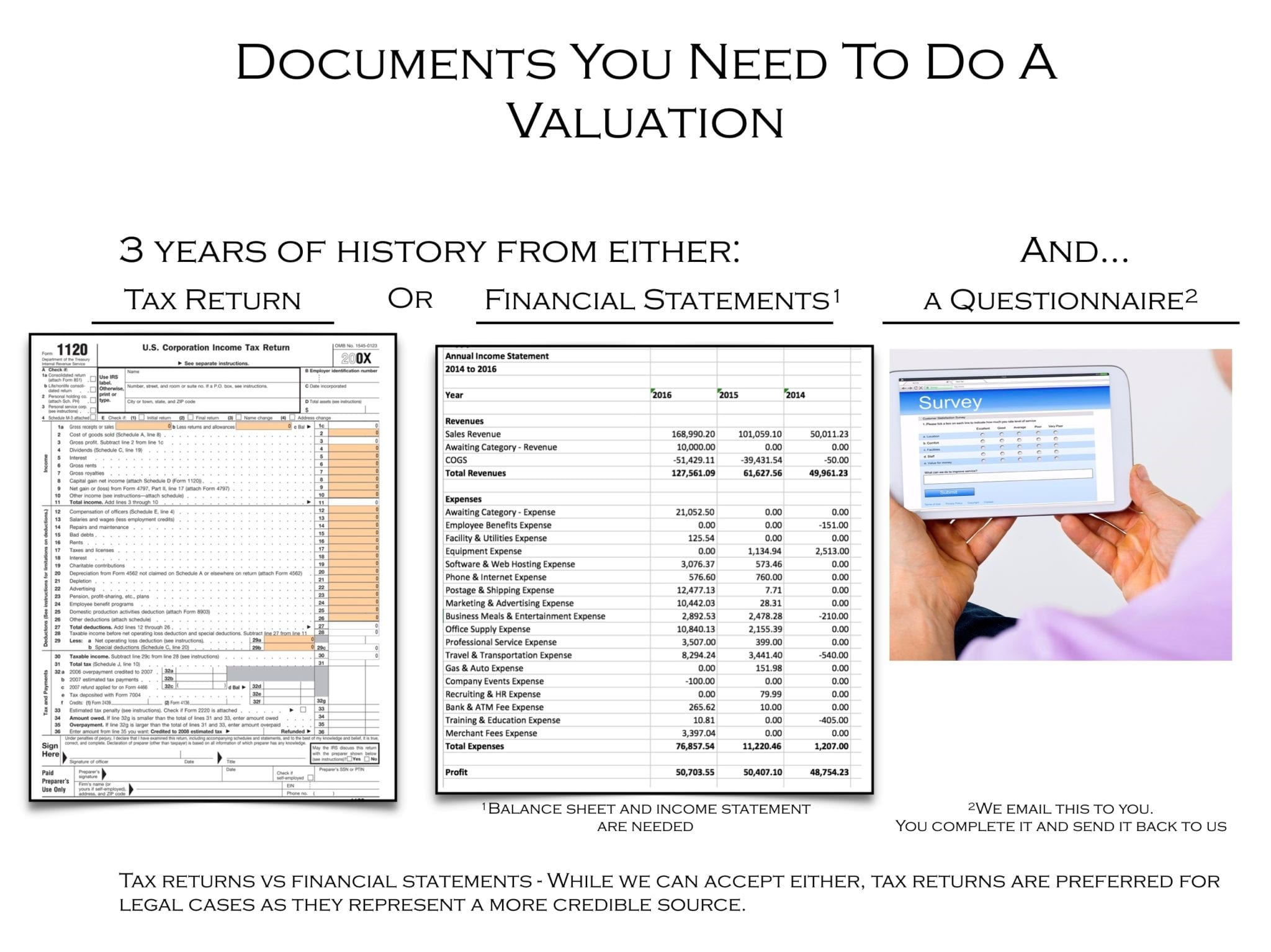

What documents do i need for a business valuation?

How does billing work?

Billing may be directed to you or your desired recipient. This is your option.

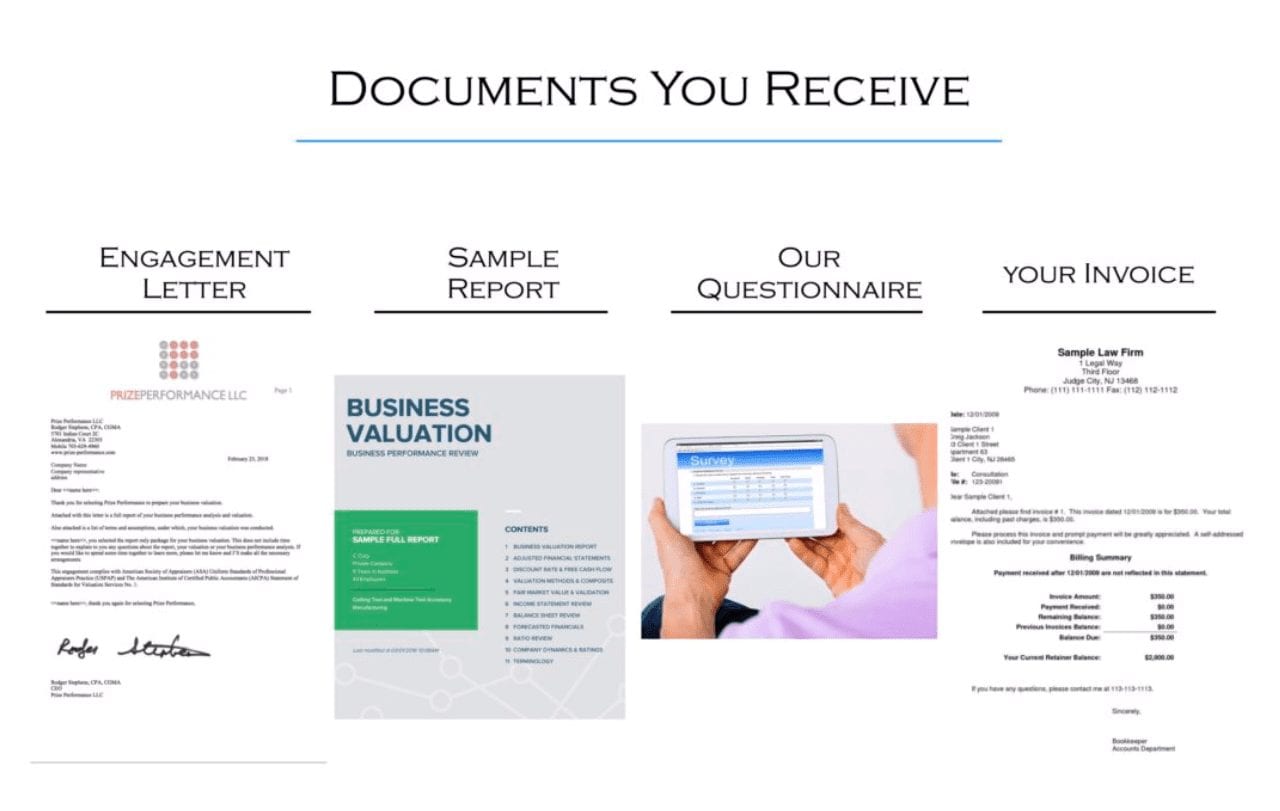

If and when you wish to proceed with a business valuation, we will prepare and present this electronic package, via email, for late-stage consideration.

What Are The Fees?

One business valuation fee dies not fit all companies. This is because each company, even if in the same industry, differentiates themselves to stand out. From the outside view, two companies may appear the same. From the inside view, they are very, very different.

More importantly, different companies have different reasons for undertaking a business valuation. Your particular situation and answers to our discussions may cause a fee to go rise or fall. In addition, we offer you three valuation options to choose from.

All of this means your ideal business valuation option, and the corresponding fee is best determined by a conversation before presenting you with a fee.

If you are considering a business valuation, and you would like to know what your business valuation fee may be, please complete the form below. I’ll contact you by phone for a conversation. During or after our conversation, I’ll present you with a fee estimate.

Below, in the message section, is a checkbox for knowing your fee. Please check this box and complete the brief questions. This will provide me with a starting point for our conversation. Please expect a phone call, from me, to go over it.

What are my choices of professionals to prepare my report?

You have certified and experienced professionals available to support your valuation. Please consider these professionals as two different options available to you. Please select your preferred professional as you wish. Fees may vary depending upon your preference of professional.

- Option 1 – Certified Public Accountants carry the CPA designation and are frequently qualified and experienced in business valuations. They may carry other non-valuation related credentials.

- Option 2 – Valuation accredited professionals carry the designations for Accredited in Business Valuations (ABV) or Accredited Senior Appraiser (ASA) or both.

Your report will be issued and signed by your preferred professional. Your fee will be adjusted upwards should you select the valuation accredited professional. This ABV professional is not required for every business valuation, however, in some situations, you may prefer this professional.

Any professional you choose will issue your report in accordance with the American Institute of Certified Public Accountants Statement of Standards for Valuation Services #1 (AICPA SSVS #1) and Uniform Standards of Professional Appraisal Practice (USPAP) explained previously.

Call For a Fee Estimate

One fee does not fit all companies. This means we need to understand some information about your company before we can estimate a fee for you. Please call and let’s talk.